As a real estate investor, you want to maximize the returns on your investments. But when it comes to mid-market multi-family real estate, it can be difficult to know where to start.

Mid-Market Multi-family real estate offer the potential for high returns, and they are becoming increasingly popular among investors.

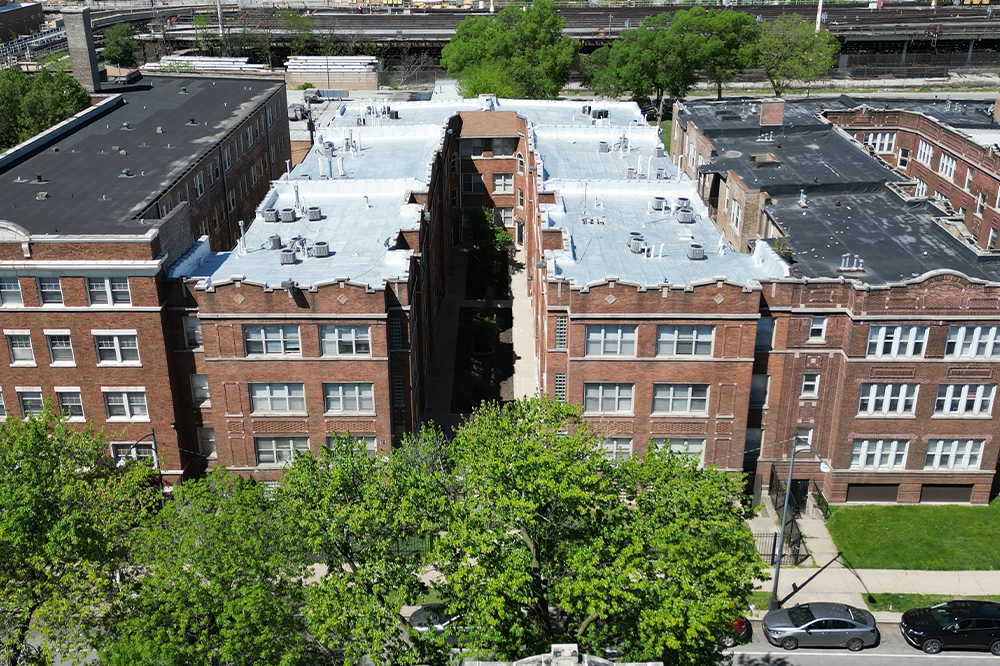

Mid-market multi-family is a type of real estate development that focuses on creating affordable housing for middle-income families. This type of development is typically designed to be more affordable than high-end luxury housing, while still providing a quality living experience. Mid-market multi-family developments typically feature amenities such as fitness centers, clubhouses, and pools, and usually have access to public transportation and other local services. These types of developments are often located in urban areas, and are intended to provide a mix of housing types to meet the needs of a diverse range of renters.

These investments can involve rental properties, apartment buildings, and other residential properties with multiple units.

But how can you maximize your returns on these investments? Here are a few tips to help you get the most out of your mid-market multi-family real estate investments:

1. Research the Market: Before investing in any multi-family real estate, it’s essential to research the local market. Look at average rental rates, vacancy rates, and other factors that could affect your returns. Understanding the current market conditions is the key to making an informed decision about where to invest.

2. Invest in High Quality Properties: Investing in high quality properties is essential for maximizing your returns. Look for properties that are well-maintained and have potential to appreciate over time. This will help ensure that you get a good return on your investment.

3. Consider Purchasing Multiple Units: Purchasing multiple units in a single property can help you maximize your returns. This is because you can spread the cost of the purchase across multiple units, which can help lower your costs and increase your potential for higher returns.

4. Utilize Financing: Financing is another great way to maximize your returns on multi-family real estate investments. By using financing, you can spread out your payments over time and reduce your upfront costs. This can help you maximize returns while also reducing your risk.

By following these tips, you can maximize your returns on mid-market multi-family real estate investments. Researching the market, investing in quality properties, considering purchasing multiple units, and utilizing financing can all help you maximize your returns. With the right strategy, you can make smart investments that will deliver long-term returns.

For many real estate investors, CRER (Chicago Real Estate Resources, Inc.) has risen to be the premier commercial brokerage firm of choice.

CRER offers professional service and representation for commercial real estate investors, tenants and lenders.

As an independent commercial real estate firm, it is our mission to offer our clientele a personalized approach. With attentiveness, effective communication, experience and market knowledge, we deliver results.